Website:

Service Providers

January 27, 2025, Online Coin Gallery

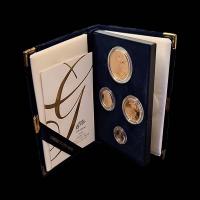

$ 310.00 USD / if 0.00 Contact Provider

0 reviews, 0 likes, 0 comments

Be the first person to like this.

January 27, 2025, Online Coin Gallery

$ 6,000.00 USD / if 0.00 Contact Provider

0 reviews, 0 likes, 0 comments

Be the first person to like this.

January 27, 2025, Online Coin Gallery

$ 5,900.00 USD / if 0.00 Contact Provider

0 reviews, 0 likes, 0 comments

Be the first person to like this.

January 27, 2025, Online Coin Gallery

$ 3,000.00 USD / if 0.00 Contact Provider

0 reviews, 0 likes, 0 comments

Be the first person to like this.

Online Coin Gallery

by Online Coin Gallery, in Collectibles, January 27, 2025

At OnlineCoinGallery, we focus on providing collectors with quality coin and currency options at affordable rates. As a business, we focus on minimizing operation expenses, such as eliminating the ...

Be the first person to like this.

Selling vs. Consigning

A regular question that comes up when dealing with a collection that needs to be placed in a new home is: Should I sell it or consign it? The answer often depends on the individual's unique situation. Typically, such situations arise out of an inheritance. Often, well-meaning parents collect items with a personal interest and the idea that their family will want and value them. Sometimes, this is the case, and that is great. Other times, what was meant with good intentions is actually a burden on the receiver. They are torn between the idea of keeping items they have no place to store or no interest in and selling such items with feelings of guilt, and they are somehow disrespecting those from whom they are being passed.

When considering re-homing a collection, there are typically four options.

Selling the items, often to wholesalers/re-sellers, with little interest or emotion. This is typically a quick option for higher-value assets.

Consigning the items using a consignment service for a fee of the overall total sales. This is often a slower process aimed at placing collectibles with like-minded individuals for the highest market value.

Selling yourself using services like eBay. Who knows who will be getting the collection, desired intent, and comes with high costs of conversion and slow turnaround.

Giving away to others.

OnlineCoinGallery.com is a good fit for those who fall into the 2nd category above.

Be the first person to like this.

January 21, 2025

88 views

In the world of personal finance and hobbies, the terms "investing" and "collecting" are often used interchangeably. While both involve acquiring assets, their purposes and approaches are fundamentally different. Understanding the distinction between investing and collecting can help individuals align their financial and personal goals more effectively.

Purpose and Motivation

The primary difference between investing and collecting lies in the motivation behind the activity. Investing is typically driven by the goal of financial growth. Investors purchase assets with the expectation that their value will increase over time, providing a return on investment (ROI) through appreciation, dividends, or interest.

Collecting, on the other hand, is often fueled by passion, personal interest, or nostalgia. Collectors acquire items for their intrinsic value, historical significance, or aesthetic appeal. While some collections may appreciate in value, financial gain is usually a secondary consideration.

Types of Assets

Investors commonly focus on financial instruments such as stocks, bonds, real estate, and mutual funds. These assets are generally liquid, meaning they can be easily bought or sold in financial markets.

Collectors, by contrast, gravitate toward tangible items like stamps, coins, art, vintage cars, or memorabilia. These items often carry sentimental or cultural significance, and their value can be subjective, depending on rarity, condition, and demand within niche markets.

Risk and Return

Investing typically involves a calculated approach to risk and return. Investors analyze market trends, historical performance, and economic indicators to make informed decisions. Although investing carries risks, these can often be mitigated through diversification and strategic planning.

Collecting, while not devoid of financial risks, is less predictable as an investment strategy. The value of collectibles can fluctuate wildly based on trends, public interest, or the discovery of additional similar items, which can dilute rarity.

Liquidity

Liquidity, or the ease of converting an asset into cash, is another key differentiator. Investments like stocks and bonds are highly liquid and can often be sold quickly at market value. Collectibles, however, tend to be illiquid. Finding a buyer willing to pay the desired price can be time-consuming, and sales often depend on the item’s niche appeal.

Emotional vs. Rational Decision-Making

Investing is generally more analytical, requiring logical decision-making based on data and projections. Collecting, conversely, is often driven by emotion. A collector might pay a premium for an item that completes a set or holds personal significance, regardless of its market value.

Overlap and Synergy

Despite their differences, investing and collecting can intersect. For example, some individuals collect rare items like fine art or vintage wines with the dual intention of personal enjoyment and potential financial appreciation. This blend of passion and strategy requires a deep understanding of the market and a willingness to hold onto assets for extended periods.

While both investing and collecting involve acquiring assets, their purposes, risks, and rewards differ significantly. Investing focuses on financial growth and wealth building, requiring a strategic and data-driven approach. Collecting, meanwhile, is rooted in personal passion and emotional fulfillment, often with less emphasis on financial return. Understanding these distinctions allows individuals to pursue their objectives—whether financial or personal—more effectively.

Be the first person to like this.

January 21, 2025

63 views

Coin collecting, also known as numismatics, is a hobby that has been cherished for centuries. Beyond its appeal as a pastime, coin collecting offers numerous benefits that span financial, historical, educational, and personal dimensions. Here are some compelling reasons why it is good to collect coins:

1.Preservation of History

Coins serve as tangible links to the past, offering insights into historical events, cultures, and economies. Each coin tells a story:

Ancient coins reflect the artistry, technology, and trade practices of bygone civilizations.

Commemorative coins celebrate significant milestones, leaders, or events, providing a window into specific periods of history.

By collecting coins, individuals play a role in preserving these historical artifacts for future generations.

2.Educational Value

Coin collecting encourages learning across multiple disciplines:

Geography:Coins often display maps, landmarks, or symbols unique to their country of origin.

Economics:Studying coins reveals the evolution of monetary systems and the impact of inflation, war, and trade on currency.

Art and Culture:The intricate designs and engravings on coins highlight the artistic traditions and values of different societies.

3.Potential for Financial Growth

While not all coins appreciate in value, rare or high-quality coins can become valuable over time. Factors influencing a coin’s worth include:

Rarity: Limited mintage or coins from defunct currencies tend to be highly sought after.

Condition: Well-preserved coins (graded as "mint state") are typically more valuable.

Historical significance: Coins linked to major events or periods often attract premium prices.

Investing in coins requires research, but it can yield financial rewards alongside personal satisfaction.

4.A Relaxing and Rewarding Hobby

Coin collecting provides a sense of achievement and relaxation:

The process of finding, identifying, and categorizing coins can be both meditative and stimulating.

Completing a specific collection, such as a series of coins from a particular country or era, offers a rewarding sense of accomplishment.

5.Building Community

Numismatics fosters connections with like-minded individuals:

Coin shows, auctions, and online forums allow collectors to share knowledge, trade coins, and build friendships.

Joining clubs or organizations provides access to resources and expert guidance.

6.A Family-Friendly Activity

Coin collecting can be an excellent hobby for families:

It bridges generational gaps, with older collectors passing down knowledge and coins to younger enthusiasts.

Parents and children can bond over shared discoveries, making the hobby an enriching experience for all ages.

7.Legacy and Inheritance

A well-curated coin collection can become a cherished family heirloom:

It serves as a tangible reminder of a collector’s interests and values.

Passing down a collection can inspire future generations to continue the tradition, preserving both family and historical heritage.

Coin collecting is much more than a simple hobby; it is a gateway to history, education, and community. Whether pursued for its intellectual stimulation, financial potential, or sheer joy, collecting coins offers lasting benefits that enrich the collector’s life. With every coin added to a collection, one builds not just a portfolio, but a legacy of knowledge, curiosity, and passion.

Be the first person to like this.

January 21, 2025

67 views

Precious metals like gold, silver, platinum, and palladium have long been valued for their rarity and intrinsic worth. However, the prices of these metals are subject to fluctuations influenced by various economic, geopolitical, and market factors. Understanding the causes behind these price movements is essential for investors, collectors, and industries relying on these materials.

1. Supply and Demand Dynamics

The fundamental principle of supply and demand plays a significant role in the price of precious metals. When demand for a metal exceeds its supply, prices typically rise. Conversely, an oversupply or reduced demand can cause prices to fall. For example:

Increased industrial use of silver in electronics can drive up its price.

A slowdown in mining production due to labor strikes or geopolitical issues can reduce supply, increasing costs.

2. Economic Indicators

Economic factors such as inflation, interest rates, and currency strength heavily influence precious metal prices.

Inflation: Precious metals, particularly gold, are often seen as a hedge against inflation. When inflation rises, the value of currency decreases, leading to increased demand for gold as a store of value.

Interest Rates: Low-interest rates make non-yielding assets like gold more attractive. Conversely, higher interest rates can lead to a shift toward interest-bearing assets, reducing demand for metals.

Currency Strength: A strong U.S. dollar often correlates with lower metal prices since metals are typically priced in dollars, making them more expensive for holders of other currencies.

3. Geopolitical Events

Precious metals are considered safe-haven assets during times of geopolitical uncertainty. Events like wars, political instability, or trade disputes can drive investors toward metals like gold and silver as a secure store of value. These situations often result in temporary price spikes.

4. Market Speculation and Investment Trends

Speculators and investors influence prices through trading activities in futures markets and exchange-traded funds (ETFs). For instance:

A sudden increase in gold ETF purchases can drive up prices.

Market speculation about central bank policies or economic conditions can also create price volatility.

5. Technological and Industrial Use

Advancements in technology and industrial applications can significantly affect the demand for certain precious metals. For example:

Palladium and platinum are critical in catalytic converters for reducing vehicle emissions, and their demand fluctuates with automotive production trends.

Silver’s use in renewable energy technologies, such as solar panels, has bolstered its demand in recent years.

6. Mining and Production Costs

The cost of extracting and refining precious metals directly impacts their market prices. Factors influencing production costs include:

Energy prices, as mining is energy-intensive.

Labor costs and regulatory changes in mining regions.

Geological challenges that make extraction more expensive.

7. Global Economic Growth

The health of the global economy affects industrial demand for metals. During periods of economic growth, industrial demand for metals like silver and platinum tends to rise. Conversely, a global economic slowdown can suppress demand and reduce prices.

8. Central Bank Policies and Reserves

Central banks play a crucial role in gold markets, as they hold significant reserves. When central banks buy gold to diversify their reserves, prices often increase. Conversely, selling off gold reserves can depress prices.

The fluctuations in precious metals are driven by a complex interplay of supply and demand, economic conditions, geopolitical events, and technological advancements. For investors and industries, staying informed about these factors is crucial to navigating the volatility and making strategic decisions. While the allure of precious metals as a store of value remains timeless, their market dynamics require careful observation and analysis.

Be the first person to like this.

Online Coin Gallery

1 like

Be the first person to like this.